Tax Brackets For Tax Year 2025. R17 235 r17 235 r16 425 r15 714 secondary (65 and older) r9 444: Federal tax brackets based on filing status.

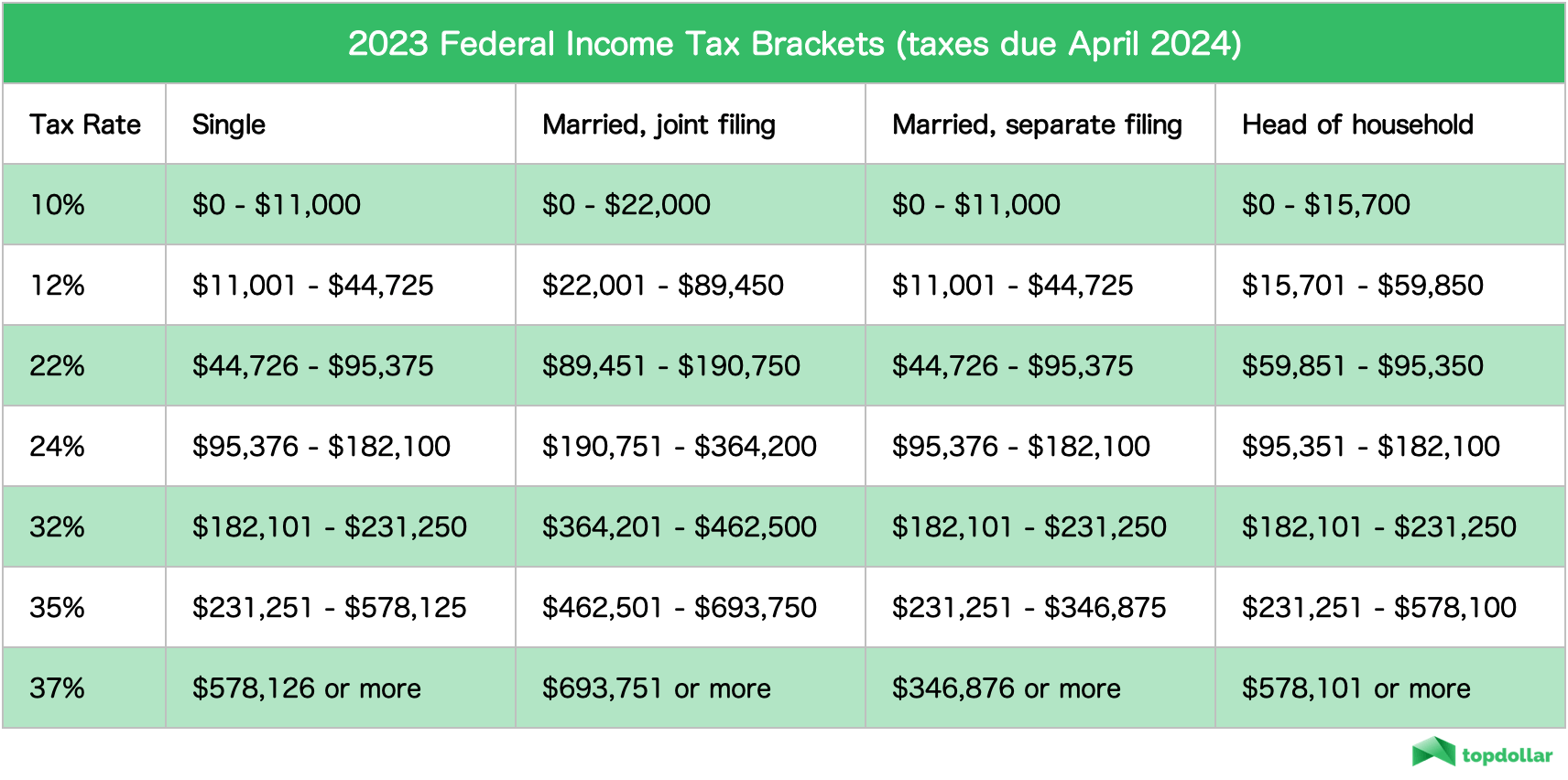

10 percent, 12 percent, 22 percent, 24 percent, 32. The federal income tax has seven tax rates in 2025:

Az Tax Brackets 2025 Arlena Olivia, In the u.s., there are seven federal tax brackets. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent.

10+ 2025 California Tax Brackets References 2025 BGH, Federal tax brackets based on filing status. Updated tax rates and brackets.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, R17 235 r17 235 r16 425 r15 714 secondary (65 and older) r9 444: However, for the 2025 tax year.

Federal Tax Revenue Brackets For 2025 And 2025 Nakedlydressed, 10 percent, 12 percent, 22 percent, 24 percent, 32. You pay tax as a percentage of your income in layers called tax.

Here's how the new US tax brackets for 2019 affect every American, The 2025 tax year features seven federal tax bracket percentages: Use the income tax estimator to work out.

Here are the federal tax brackets for 2025 vs. 2025, R17 235 r17 235 r16 425 r15 714 secondary (65 and older) r9 444: The 2025 tax year features seven federal tax bracket percentages:

Really? My Bonus is Taxed the Same as my Paycheck? — Human Investing, How much of your income falls within each tax band; R9 000 r8 613 tertiary (75 and older).

Tax filers can keep more money in 2025 as IRS shifts brackets The Hill, See current federal tax brackets and rates based on your income and filing status. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Federal Payroll Tax Tables Elcho Table, Tax brackets for people filing as single individuals for 2025. You pay tax as a percentage of your income in layers called tax.

IRS Tax Brackets AND Standard Deductions Increased for 2025, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent. Tax year 2025 2025 2025: